AI Disclaimer: As a writer, I use AI-powered tools responsibly to help with research, brainstorming, and editing. This allows me to more efficiently explore a topic and refine my ideas, though all final content and analysis are my own.

The gap between AI capability and practical governance is costing the industry billions. And creating systemic risk we're only beginning to understand.

Financial services executives love talking about AI transformation. What they're less eager to discuss? The governance mess they're creating while chasing competitive advantage.

After working with COOs across £2 trillion in assets, the pattern is clear. Institutions are implementing AI faster than they're building frameworks to manage it. The result isn't just compliance risk. It's operational exposure that could reshape competitive dynamics across the sector.

The Implementation Reality

Consider the numbers driving current AI adoption. Bank of America's Erica chatbot exceeded 3 billion client interactions by 2025, serving nearly 50 million users since launch and averaging more than 58 million interactions monthly. HSBC's AI anti-money laundering system identifies 2-4 times more suspicious activities while reducing false alerts by 60%.

These aren't pilot programs. They're production systems handling billions in daily transactions.

Yet when you examine the governance frameworks supporting these implementations, the picture becomes concerning. The Bank of England's 2024 AI report reveals that while 75% of UK financial firms are using AI, and 81% employ some kind of explainability method, only 34% of firms report having "complete understanding" of their AI technologies, with 46% admitting to only "partial understanding". The challenge isn't the absence of explainability methods, but their adequacy for meeting evolving regulatory requirements.

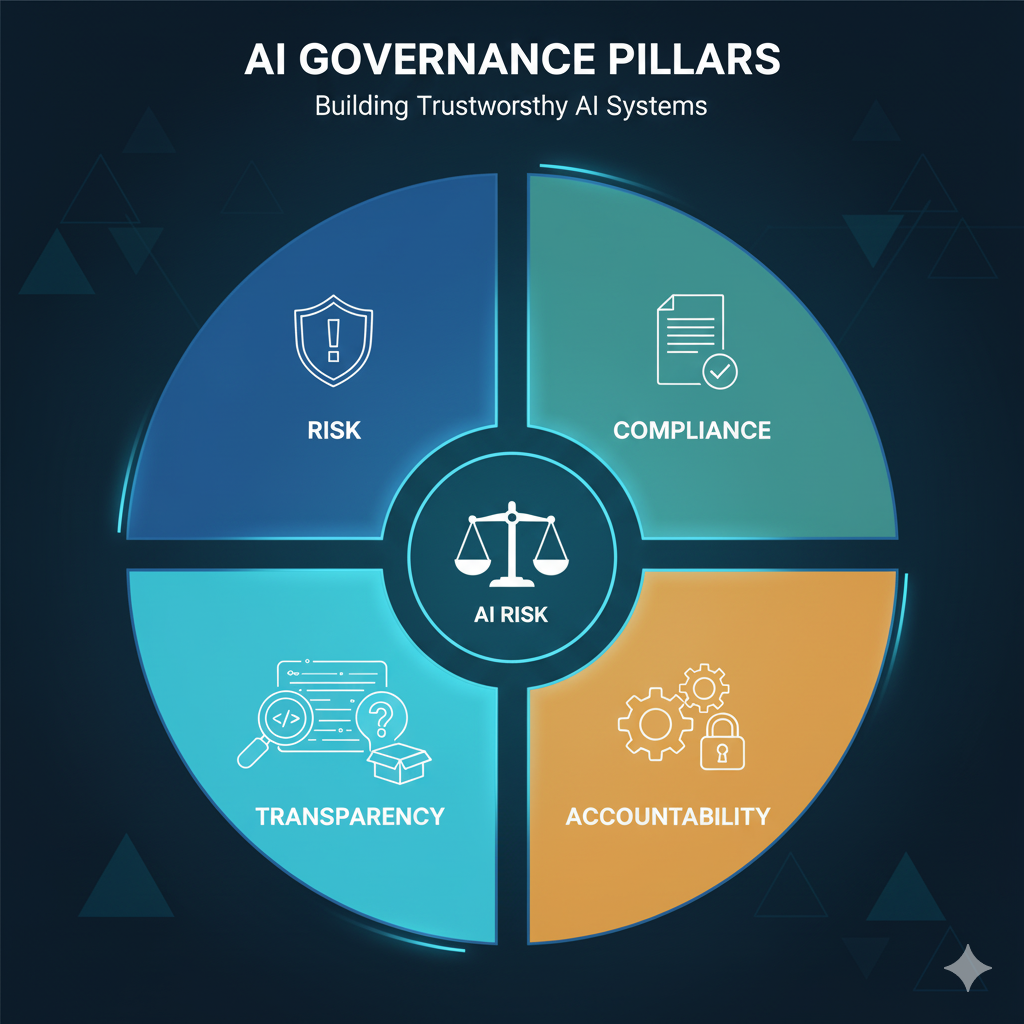

This isn't a technology problem. It's a governance problem that stems from a fundamental misunderstanding of what AI governance actually requires.

Where Traditional Risk Management Breaks Down

Financial services has sophisticated risk management. We've built frameworks that handle market volatility, credit exposure, operational failures, and regulatory changes. So why are we struggling with AI risk?

The answer lies in AI's unique characteristics that don't map neatly onto traditional risk categories:

Continuous Learning

Traditional models are static until deliberately updated. AI systems evolve constantly, making point-in-time risk assessments inadequate. A credit scoring algorithm that performed acceptably last quarter might exhibit bias today based on recent training data updates.

Third-Party Dependencies

Most AI capabilities, especially generative AI, come from external providers. The Bank of England's 2024 report shows that a third of all current AI use cases are third-party implementations, significantly higher than the 17% reported in 2022. This concentration risk didn't exist when institutions built their own rule-based systems.

Explainability Challenges

Regulations increasingly demand clear explanations for adverse decisions, particularly in lending. Yet many AI systems operate as "black boxes" where even their creators cannot fully explain specific decisions.

Data Amplification

AI systems can magnify existing biases in training data, creating discrimination that violates fair lending laws even when no discriminatory intent exists. As one compliance officer told me: "Discrimination is discrimination no matter the cause."

Frankly, these aren't edge cases. They're fundamental characteristics of how AI works.

The Regulatory Response

Regulators worldwide are scrambling to address these challenges, but their approaches diverge significantly.

The European Union's AI Act takes a prescriptive approach, mandating specific governance requirements for high-risk AI systems in finance. Credit assessment and insurance risk pricing fall into this category, requiring comprehensive risk management systems, human oversight, and detailed documentation. Non-compliance carries fines up to 6% of global turnover.

The UK's Financial Conduct Authority favors outcome-based regulation through Consumer Duty requirements. Firms must demonstrate that AI systems deliver fair customer outcomes, but the FCA provides limited guidance on how to achieve this in practice. It's a principles-based approach that leaves firms figuring out the details.

Singapore's Monetary Authority has developed detailed principles through Project Veritas and FEAT guidelines, emphasizing proportionate governance based on AI system risk levels. This approach recognizes that chatbots for customer service require different oversight than algorithms making lending decisions.

The United States maintains technology-neutral regulation, applying existing requirements to AI systems. While this avoids prescriptive rules, it leaves institutions guessing about compliance requirements for novel AI capabilities.

This regulatory fragmentation creates operational complexity for multinational institutions while establishing clear compliance obligations that many firms aren't prepared to meet. In practice, firms end up trying to comply with the most stringent requirements everywhere.

The Governance Gap

The real issue isn't regulatory uncertainty. It's the disconnect between AI capabilities and practical governance implementation.

Most AI governance initiatives fail because they approach the challenge backwards. Institutions start with theoretical frameworks about AI ethics and algorithmic fairness, then struggle to translate these concepts into day-to-day operations.

Effective AI governance starts with understanding what your AI systems actually do, how they make decisions, and where they could go wrong. This requires technical expertise that most risk teams lack, combined with business understanding that most technology teams don't prioritize.

Consider bias detection, a fundamental AI governance requirement. The theoretical approach involves statistical testing for discriminatory outcomes across protected classes. The practical implementation requires ongoing monitoring systems, clear escalation procedures when bias is detected, and business processes for remediation that don't disrupt customer service.

Few institutions have successfully bridged this gap between theory and practice. It's worth noting that this isn't just about having the right policies. It's about having people who can actually implement them.

Building Practical Governance

Effective AI governance requires five fundamental capabilities that most financial institutions haven't developed:

Inventory and Classification

You cannot govern what you cannot see. Institutions need comprehensive inventories of AI systems, their business purposes, data sources, and decision-making processes. This sounds straightforward until you realize that many AI capabilities are embedded in third-party software that institutions don't directly control.

Risk-Based Controls

Not all AI systems require the same oversight. A chatbot answering basic customer questions poses different risks than an algorithm determining loan approvals. Governance frameworks must be proportionate to actual risk levels, not theoretical concerns about AI in general.

Ongoing Monitoring

Traditional model validation occurs annually or when models are updated. AI systems require continuous monitoring for performance drift, bias emergence, and data quality degradation. This demands new capabilities and resources that most institutions haven't allocated.

Cross-Functional Expertise

AI governance sits at the intersection of technology, risk management, compliance, and business operations. Success requires teams that can translate between these disciplines, not just coordinate between separate functions. Frankly, these people are rare.

Vendor Management

When critical AI capabilities come from external providers, governance extends beyond internal controls to vendor oversight. This includes access to model documentation, performance monitoring data, and validation of vendor claims about system capabilities.

In practice, most institutions have gaps in at least three of these five areas.

The Cost of Getting It Wrong

The consequences of inadequate AI governance extend beyond regulatory fines.

Operational failures can be immediate and severe. When AI systems make incorrect decisions at scale, the impact affects thousands of customers simultaneously. A biased lending algorithm doesn't just create compliance risk. It damages customer relationships and brand reputation while potentially excluding entire market segments.

Competitive risks are subtler but potentially more significant. Institutions with robust AI governance can deploy new capabilities faster because they've built frameworks for rapid risk assessment and control implementation. Those without governance capabilities face longer implementation timelines and higher compliance costs.

Strategic risks emerge from over-reliance on external AI providers. Institutions that depend on third-party AI services without understanding their limitations or developing alternative capabilities face concentration risk that could affect business continuity.

It's worth noting that these risks compound over time. The longer an institution waits to build proper governance, the more expensive it becomes to retrofit controls onto existing systems.

The Path Forward

Financial services needs to approach AI governance as an operational capability, not a compliance exercise.

This means building teams that understand both AI technology and financial services operations. It requires governance frameworks that evolve with AI capabilities rather than trying to force new technology into existing risk categories. Most importantly, it demands leadership commitment to investing in governance infrastructure before problems emerge, not after regulatory actions or operational failures.

The institutions that get this right will gain sustainable competitive advantage. They'll deploy AI capabilities faster, with greater confidence, and lower long-term risk. Those that don't will find themselves constrained by governance debt that becomes more expensive to address over time.

The AI transformation in financial services is inevitable. The question is whether institutions will build the governance capabilities to manage it effectively, or whether they'll learn these lessons through costly failures.

The choice, for now, remains theirs to make. But that window is closing faster than most executives realize.

Sources Referenced

Tier 1 (Primary Sources):

About Terry Yodaiken

Terry Yodaiken advises financial institutions on AI governance and operational transformation. He works with COOs across £2 trillion in assets and has led technology implementations across 15+ jurisdictions. His firm, POVIEW.AI, helps institutions bridge the gap between AI capability and practical governance.

Ready to Build Practical AI Governance?

Don't wait for regulatory action or operational failures. Get ahead of the curve with proven governance frameworks.

Book a Consultation