Author's note: I use AI-powered tools responsibly for research, brainstorming, and editing. They help me explore topics and refine ideas faster, but the final content and analysis remain my own.

The conversation around AI in asset management has changed radically. We've moved past the "if" stage—nobody doubts its impact anymore. What's being asked now is: how fast can we implement, and where should we focus?

From my work with COOs in firms overseeing more than £2 trillion in assets, I see a widening gulf. The leaders treat AI like infrastructure; the rest still tinker with pilots. Month by month, that gap gets harder to close.

Where AI Delivers Commercial Impact That Matters

In practice, three clusters of use cases stand out. Not theory, but real deployments with measurable commercial outcomes.

.png)

New Business Development

Client acquisition is still relationship-driven, but the mechanics are shifting. Morgan Stanley's knowledge assistant—piloted with 900 advisors before a broader rollout—shows what's possible when AI is embedded in day-to-day work. Today, 98% of their advisor teams use it routinely.

The leap isn't just about speed. It's about predictiveness: spotting prospects before they hit the radar elsewhere. Some managers are using AI to rank prospects by warmth, not just demographic fit. That flips prospecting from reactive to proactive.

Pitchbooks are another case. Generic decks are falling out of favour as AI enables tailored materials in hours. An investment manager can now produce a prospectus tuned to an individual's portfolio quirks and risk appetite—something impossible at scale before.

Client Retention and Service

Churn models used to mean basic dashboards. Now they pull signals from call transcripts, notes, even subtle patterns in email exchanges. Lloyds Bank's survey showed 59% of institutions reporting productivity gains from AI, and one third citing better client experience. That's not window-dressing; it's genuine retention value.

Service desks also benefit. A client call that once needed multiple follow-ups can now be resolved in real time with an AI assistant trained on internal manuals. The human relationship stays central, but the support layer is sharper and faster.

Operational Efficiency

Efficiency gains are easier to measure. UK Finance reports Tier 1 institutions cutting compliance reporting time by 60% with generative AI support. HighRadius, in another domain, has automated up to 85% of cash reconciliation. That's capacity reclaimed for actual client service.

Other firms are using GenAI to scan and summarize long regulatory texts, produce attribution reports, or generate market commentaries that are client-specific. The common thread: more output, less manual grind.

The Investment Decision Frontier

.png)

More ambitious use cases touch portfolio construction itself. Financial institutions are experimenting with scenario simulation and model-based optimisation. Importantly, these systems run alongside human decision-makers. AI surfaces alternative views and drafts assessments, but the judgment remains with professionals.

The real change is volume: research coverage expands, not contracts. Analysts don't stop reading markets—they simply read with help.

Adoption Patterns Across the Industry

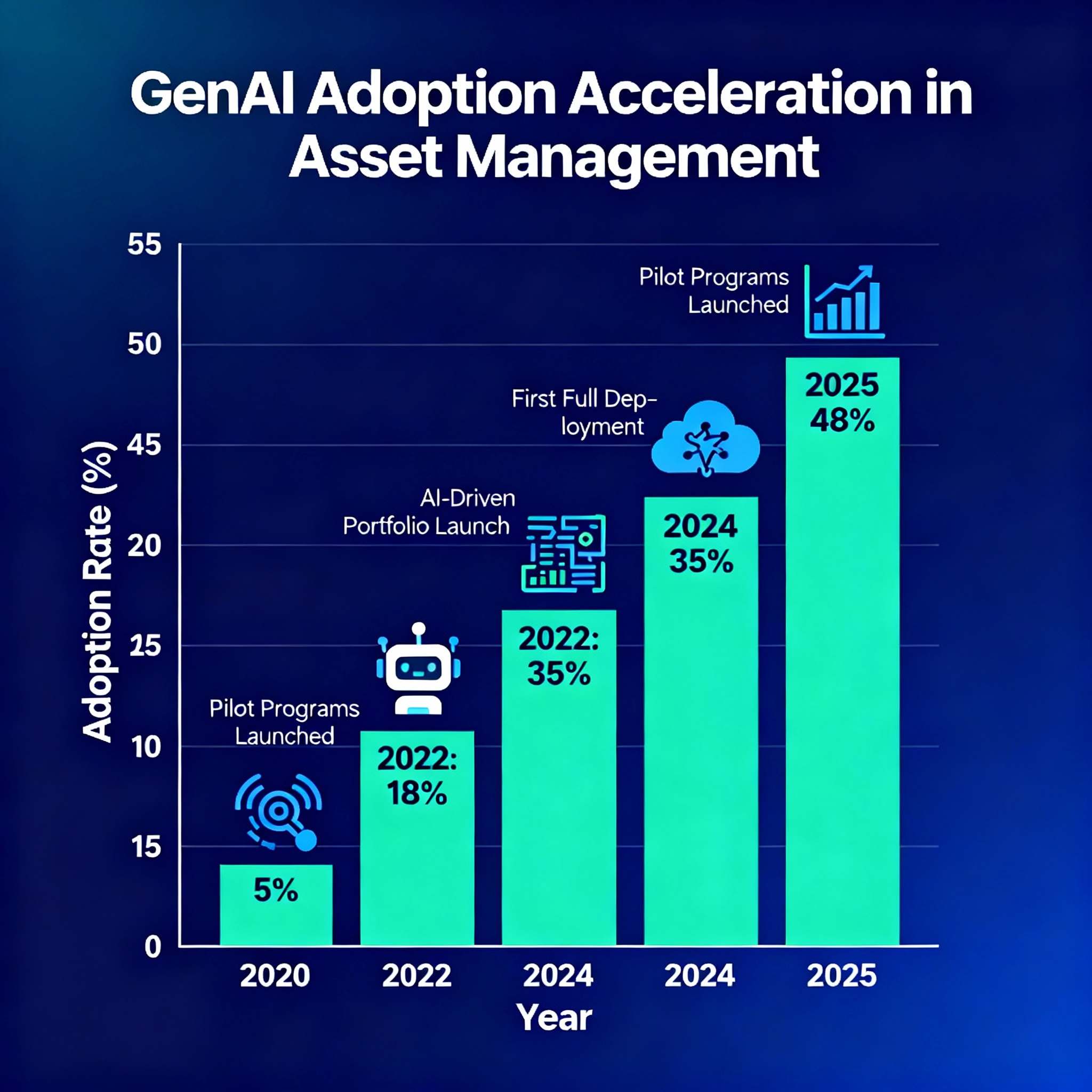

The acceleration is stark. In 2023, only about 30% of banks reported scaled AI use; by late 2025 it was more than 70%. NVIDIA's 2025 survey found nearly 70% of firms linking AI adoption to revenue gains of 5% or more, with 60% citing cost reductions.

The successful adopters have common traits: they invest as though AI were core infrastructure, they aim for business outcomes not "cool tech," and they stick with multi-year programs rather than chasing quarterly wins.

Implementation Approaches Emerging

Three broad strategies are visible, though firms mix them in practice:

Platform-centric integration

AI embedded into core enterprise systems. Good for governance, slower for innovation.

Federated tools strategy

Multiple assistants for different tasks, model-agnostic, fast-moving but integration-heavy. Goldman Sachs, for example, has around 10,000 employees using its GS AI Assistant for summarising and analysis.

Selective automation

Narrow, bounded workflows automated first. Less flashy, but lower risk.

Not every firm declares a strategy upfront. Many stumble into one of these tracks based on internal politics or vendor influence.

Governance: The Catch-Up Race

.png)

Here's the rub: governance. Once AI spreads across thousands of staff and billions of AUM, old model-risk frameworks buckle. Regulators are already probing explainability, accountability, and privacy.

Sophisticated firms are embedding controls at deployment, not bolting them on later. Audit trails, model validation routines, and oversight committees are becoming standard. Those who ignore this risk costly remediation when supervisors come knocking.

Strategic Logic for Investment

Despite evidence, resistance lingers. Cost-conscious leaders balk at multi-year investments. But differentiation in asset management is tilting towards relationship depth and responsiveness, not product performance alone. ROI usually takes 12–24 months to surface. Waiting, though, leaves competitors to entrench.

It's a strategic bet: pay now, or pay more later through lost ground.

What Comes Next

Executives face a tension between speed and safety. Move fast, and you risk regulatory blowback. Move slowly, and competitors outpace you. The first firms to balance both will lock in advantage.

What seems clear is that AI in asset management is past "experimentation." It is now operational. The debate for boards is not if but how fast—and whether they can train their people and build governance quickly enough to avoid the pitfalls that loom.

References

- Morgan Stanley. Press releases and investor communications. 2024.

- Goldman Sachs. Internal communications and public statements. June 2025.

- NVIDIA. State of AI in Financial Services Report. February 2025.

- UK Finance. Generative AI in action: opportunities & risk management in financial services. 2025.

- Lloyds Banking Group. UK financial institutions double down on AI as productivity surges. Sept 2025.

- Gartner. Industry adoption estimates. 2025.

- McKinsey Global Institute. The economic potential of generative AI. 2023.

- Various banking technology industry reports. Methodology not independently verified.

Ready to Drive Your AI Advantage?

POVIEW.AI helps investment managers implement governed, measurable AI solutions that deliver commercial impact.

Let's Discuss Your AI Strategy